Co-browsing feature is now available for the taxpayer, to know more kindly refer latest updates. The Online return form ITR-A, for filing modified return u/s 170A is now enabled. Refer to Directorate of System's notification no 05 of 2022 dated 29th July, 2022. ITRs filed after 31st July 2022 need to be verified within 30 days.

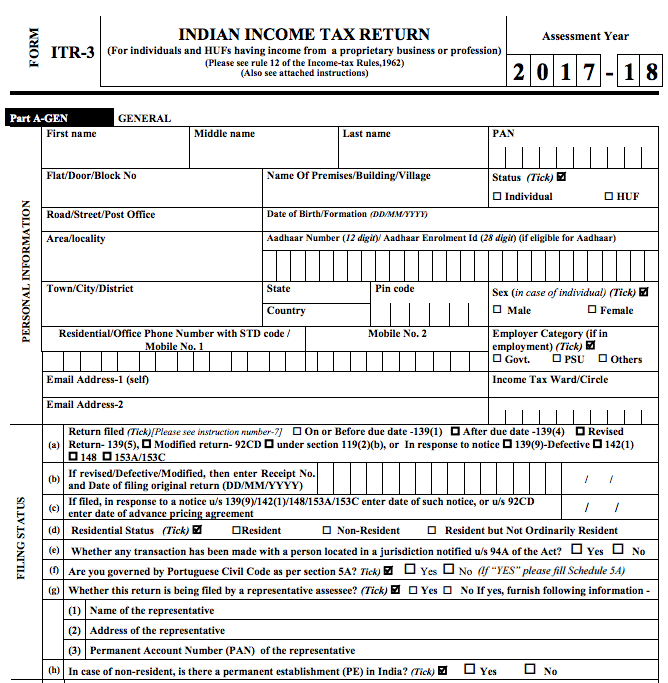

Functionality for filing of rectification request in respect of orders passed by CsIT(Appeals) is live. Income tax return form (ITR-3) is meant for individuals and HUFs who have income from the head Profits or gains from business and profession and who are not eligible to file SUGAM Form ITR -4. Other taxes like advance tax, Self-assessment tax, refund etc., would be available in AIS (Annual information statement) 8. From AY 2023-24 onwards, Form 26 AS display only TDS/TCS data. Pre-login Comply to Notice functionality is available now. The list of banks available for e-Pay Tax service at e-Filing portal is provided in the Latest Updates dated 2 6. Download latest version of em-signer for using DSC at the website. Last date of linking PAN with Aadhaar has been extended till 30th June, 2023.

Form 69 is available for filing on the portal until 31st March 2023, in pursuance of Notification No. The relaxation provided to Non-residents neither having PAN nor required to obtain it, to furnish the Form 10F manually, has been further extended to 30th September, 2023. Central & State Government Department/Approved Undertaking Agencyġ.Deductions on which I can get tax benefit.

0 kommentar(er)

0 kommentar(er)